The Australian new car market hit a record 1,241,037 deliveries in 2025, but the total only tells a small part of the story.

Over the past 11 years, overall market growth has been modest – up 85,629 units or 7.4 percent compared to 2015. The real change has been within the overall market as demand shifted away from traditional passenger vehicles towards SUVs and, to a lesser extent, light commercial vehicles.

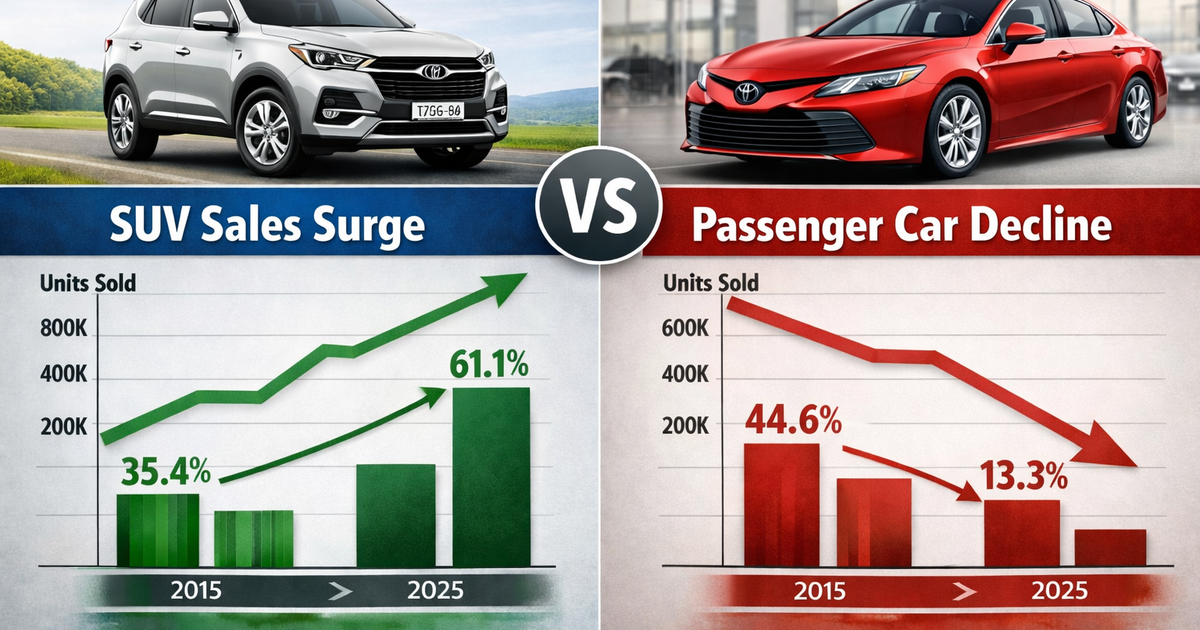

In 2015, cars were still the backbone of the market. They accounted for 515,683 deliveries or 44.6 percent of all new vehicles sold this year. Although SUVs were already popular, they lagged behind with 408,471 deliveries and a share of 35.4 percent.

Light commercial vehicles (vans and vans) accounted for 199,070 sales (17.2 percent), while heavy commercial vehicles accounted for only 2.8 percent of the market.

With Daily Sparkz you can save thousands on a new car. Click Here to get a great deal.

By 2025, this hierarchy will have been completely rewritten.

Car deliveries fell to 164,847, meaning their market share shrank to 13.3 percent. SUVs rose to 757,697 deliveries and achieved a share of 61.1 percent. Light commercial vehicles rose to 273,229 (share 22.0 percent), heavy commercial vehicles grew to 45,264 (3.6 percent).

The scale of change is enormous. Between 2015 and 2025, passenger cars lost 350,836 annual sales (minus 68.0 percent). In the same period, 349,226 SUVs were sold (plus 85.5 percent). The difference between these two numbers is only 1,610 vehicles, which shows that almost all of the decline in car demand has been absorbed by SUVs and has not completely disappeared from the market.

The transition was not instantaneous, but the data shows several clear turning points.

- 2017 is the crossover year in which SUVs (465,646) were sold more than cars (450,012) for the first time.

- 2021 is the year in which SUVs will take over the majority of the market for the first time with a share of 50.6 percent

- In 2022, passenger cars fell below a 20 percent market share – a threshold from which they have not recovered since

Even the sharp decline in overall sales in 2020, when the market fell to 916,968 deliveries, failed to reverse the trend. Passenger cars fell to 222,103 sales this year, while SUVs still recorded 454,701 deliveries and were already approaching a majority share. When volumes recovered in the years after the Corona crisis, growth flowed almost exclusively into SUVs and light commercial vehicles, not back into passenger cars.

Light commercials tell a more measured story. From 199,070 sales in 2015, the segment increased to 273,229 in 2025, an increase of 74,159 vehicles (+37.3%). Their market share increased from 17.2 to 22.0 percent over the decade.

The share of light commercial vehicles peaked at 24.1 percent in 2021 before declining slightly due to the renewed acceleration in SUV growth. Unlike passenger cars, light trucks and vans have never experienced a structural collapse; Instead, they became increasingly popular alongside SUVs.

Sales of heavy commercial vehicles also rose in absolute numbers from 32,184 to 45,264 deliveries (+40.6 percent), but their share of the overall market remained relatively stable and peaked at 4.4 percent in 2022.

One of the most telling aspects of the data is how small the overall expansion was compared to the internal restructuring. The overall market increased sales by 85,629 between 2015 and 2025, but this net growth masks a reallocation of more than 350,000 units away from passenger cars.

In terms of share, cars lost 31.3 percentage points over the decade, while SUVs gained 25.7 percentage points. Light commercials earned 4.8 points, heavy commercials earned 0.9 points.

The market didn’t just “grow into SUVs.” Instead, buyers have actively replaced one body style with another, transforming what was once a market dominated by traditional cars into one where SUVs are now the default choice.

By 2025, almost two-thirds of all new vehicles sold in Australia were SUVs and fewer than one in seven passenger cars. This reality has implications that go far beyond the annual sales charts.

It shapes which models automakers prioritize for Australia, which segments attract the most competition and which nameplates struggle to justify ongoing investment. This also explains why new brands’ strategies in recent years have predominantly focused on SUVs and small cars rather than conventional hatchbacks or sedans.

Segment volumes and shares, 2015-2025

| Year | Total market | passenger | SUV | Light advertising | Heavy commercial |

|---|---|---|---|---|---|

| 2015 | 1,155,408 | 515,683 | 408,471 | 199,070 | 32,184 |

| 2016 | 1,178,133 | 486,257 | 441,017 | 217,750 | 33,109 |

| 2017 | 1,189,116 | 450,012 | 465,646 | 236,609 | 36,849 |

| 2018 | 1,153,111 | 378,413 | 495,300 | 237,972 | 41,426 |

| 2019 | 1,062,867 | 315,875 | 483,388 | 225,635 | 37,969 |

| 2020 | 916,968 | 222,103 | 454,701 | 205,597 | 34,567 |

| 2021 | 1,049,831 | 221,556 | 531,700 | 253,254 | 43,321 |

| 2022 | 1,081,429 | 203,056 | 574,632 | 256,382 | 47,359 |

| 2023 | 1,216,780 | 211,361 | 679,462 | 274,185 | 51,772 |

| 2024 | 1,237,287 | 211,073 | 704,557 | 270,351 | 51,306 |

| 2025 | 1,241,037 | 164,847 | 757,697 | 273,229 | 45,264 |

Change by segment, 2015-2025

| segment | 2015 | 2025 | Absolute change | % change |

|---|---|---|---|---|

| Total market | 1,155,408 | 1,241,037 | +85,629 | +7.4 |

| passenger | 515,683 | 164,847 | −350,836 | −68.0 |

| SUV | 408,471 | 757,697 | +349,226 | +85.5 |

| Light advertising | 199,070 | 273,229 | +74,159 | +37.3 |

| Heavy commercial | 32,184 | 45,264 | +13,080 | +40.6 |

Interesting facts

- In 2017, SUVs overtook cars for the first time

- SUVs became the majority segment in 2021

- The market share of passenger cars fell below 20 percent in 2022

- The SUV growth between 2015 and 2025 (+349,226) corresponds almost exactly to the decline in passenger cars (-350,836).

- Light commercial vehicles reached their highest share in 2021 (24.1 percent)

MORE: Another record year for new car sales in Australia, but modest growth overall in 2025